What is Efficient Growth—and Why Does It Matter?

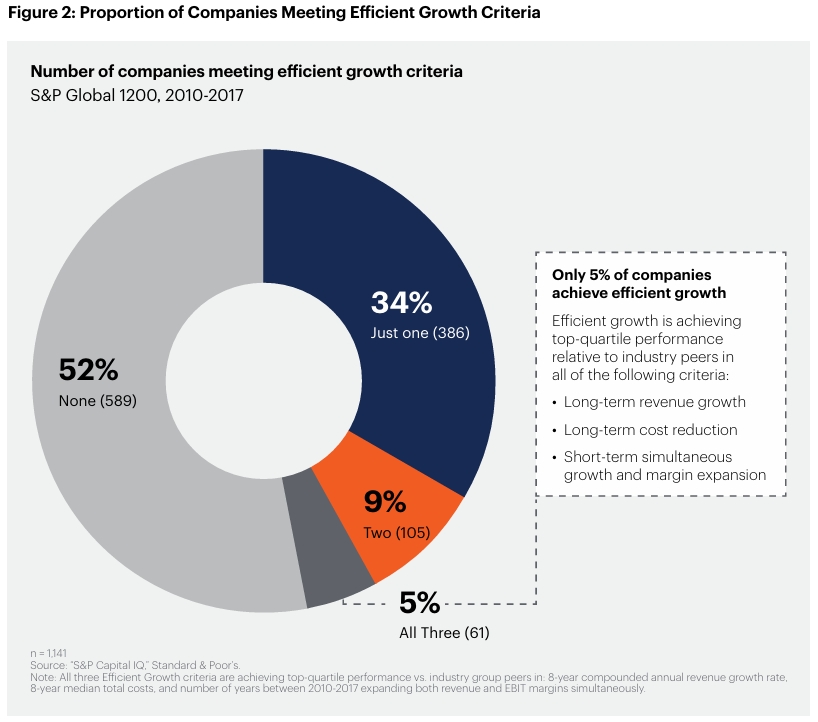

In today’s competitive business landscape, only 5% of companies achieve what Gartner calls “efficient growth”—a rare combination of top-line revenue growth and bottom-line margin expansion. These elite performers enjoy a 7.1% return premium over their peers, proving that sustainable success isn’t just about growing fast—it’s about growing smart and sustainable.

But what exactly sets these companies apart? And how can CFOs replicate their success?

The Three Pillars of Efficient Growth

Gartner’s research identifies three critical criteria that define efficient growth companies:

- Top-quartile revenue growth (8-year compound annual growth rate)

- Bottom-quartile costs (relative to industry peers)

- Consistent expansion of both revenue and EBIT margins

Only 5% of S&P Global 1200 firms meet all three benchmarks. The rest fall short due to common pitfalls like:

- Chasing competitors instead of differentiating

- Avoiding bold, long-term investments

- Overcorrecting underperforming projects instead of scaling winners

5 Strategies CFOs Can Steal from Efficient Growth Leaders

1. Manage Costs Countercyclically

Efficient companies cut costs during strong economic cycles and invest aggressively during downturns. Example:

BNSF Railway tests investment resilience across economic phases, ensuring adaptability.

2. Remove “Growth Anchors”

Finance processes often unintentionally stifle innovation. Solution?

T. Rowe Price allocates budgets based on strategic importance, not past performance.

Celgene funds proof-of-concept tests to de-risk bold projects early.

3. Double Down on Overperformers

Most companies waste resources fixing failing projects. Winners redirect capital to top performers. Example:

T. Rowe Price reserves unallocated funds for high-priority initiatives.

4. Build Scale, Not Scope

Efficient firms simplify operations by:

- Competing in 20% fewer industries

- Consolidating 24% fewer product lines

- Concentrating revenue in core markets

5. Differentiate Costs Strategically

Not all costs are equal. Leaders optimize spending on differentiation drivers, yielding 42% better long-term value. Example:

Allianz Life uses the “Rule of 10s” to test cost assumptions for innovative projects.

The Digital Transformation Trap

While digital investments can boost efficiency, they backfire if they cannibalize existing revenue. The key? Focus on tech that enhances operating leverage, not just flashy upgrades.

Key Takeaway: CFOs as Growth Architects

Efficient growth isn’t luck—it’s disciplined execution. By adopting these strategies, CFOs can:

✅ Outperform peers with a 7.1% return premium

✅ Balance growth and profitability sustainably

✅ Future-proof their cost structure

🔗 Links for More:

Download and read the e-book on Gartner website or from NeoForm LinkedIn page.

📌 About NeoForm:

NeoForm Business Partners helps businesses transform their financial strategy, planning and performance through cutting-edge tools and frameworks. Visit our blog for more insights.

Ready to transform your growth strategy? Book a consultation with NeoForm’s partners today!

3 Comments

New Transformative Role of Modern CFO - NeoForm Business Partners

[…] Efficient Growth: Key Lessons for CFOs from Top Performers […]

The 2025 B2B Sales Growth & Excellence by Using AI and Intelligent Pricing - NeoForm Business Partners

[…] Efficient Growth: Key Lessons for CFOs from Top Performers […]

Cost Transformation 2025: Beyond Cutting to Strategic Reinvention - NeoForm Business Partners

[…] Efficient Growth: Key Lessons for CFOs from Top Performers […]

Comments are closed.