Introduction

The role of the Chief Financial Officer (CFO) has evolved dramatically over the past decade. No longer confined to traditional number-crunching, today’s CFOs are strategic leaders driving organizational transformation. The Pioneering CFO report by Raconteur, sponsored by Board International, highlights how CFOs are spearheading smarter decision-making by leveraging data, predictive analytics, and advanced technologies.

In this blog post, we’ll explore:

- The shifting role of the CFO from bean counter to strategic navigator.

- How data is becoming the DNA of modern organizations.

- The challenges and opportunities in real-time decision-making.

- The growing collaboration between CFOs and HR in workforce planning.

- Why predictive analytics is the future of finance leadership.

Let’s dive in!

The Evolution of the CFO: From Beancounter to Strategic Leader

The Inflection Points

The 2008 financial crisis and the COVID-19 pandemic were pivotal moments for CFOs. These events forced finance leaders to step beyond traditional roles and become key business partners. According to Gavin Fallon of Board International:

“The CEO is the captain of the ship, but the CFO navigates through uncharted waters. CFOs must move from paper-based navigation to sophisticated GPS—enabling data-driven decision-making.”

The Split in Finance Functions

Many organizations now see a divide in finance teams:

- Transactional Teams – Focused on traditional accounting and compliance.

- Strategic Teams – Driving business insights, forecasting, and cross-functional decision-making.

The pandemic accelerated this shift, emphasizing the need for real-time financial visibility.

Key Takeaways:

✅ CFOs must lead digital transformation in decision-making.

✅ They need high-performance analytical tools to unify data.

✅ AI and predictive analytics are critical for future success.

Making Data the DNA of Your Organization

The Pandemic as a Catalyst

COVID-19 pushed CFOs to rethink data strategies. Many realized that gut instinct alone wasn’t enough—data-driven insights were essential for agility.

Chris Argent (Generation CFO) notes:

“The increased demands on planning and cash have led CFOs to overhaul finance team agility, talent, tools, and processes.”

Overcoming Data Transformation Barriers

Despite enthusiasm, challenges remain:

| Barrier | Solution |

| Cultural resistance | Educate teams on data’s value |

| Siloed legacy systems | Advocate for unified platforms |

| Lack of analytical skills | Invest in training & talent |

Joe Scarboro (CFO, AltViz) emphasizes:

“If CFOs can’t explain what data shows and why it’s helpful, it’ll get lost. Data must be linked to business strategy.”

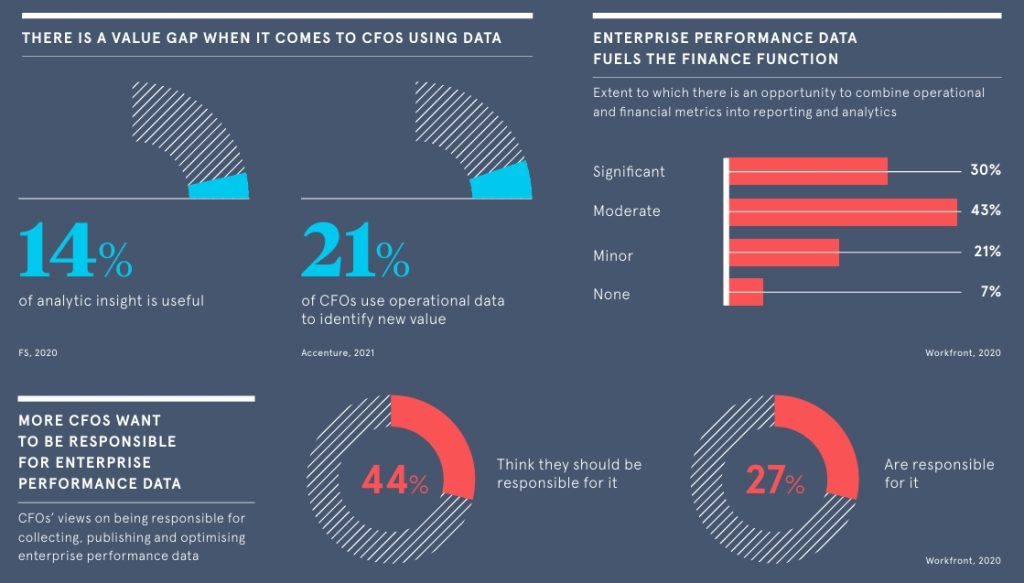

The Value Gap in Analytics

Shockingly, only 14% of analytic insights are deemed useful (FR, 2020). CFOs must ensure data is actionable, not just collected.

Real-Time Data: The Holy Grail of Decision-Making for CFOs

The Promise vs. Reality

A survey of CFOs at $1B+ companies reveals:

- 99% believe real-time data is critical.

- Only 16% have achieved it real-time data analysis (Accenture, 2020).

Jenny Himsley (CFO, Arkk Solutions) explains:

“Legacy systems in older conglomerates are the biggest roadblock. Boards must align on data presentation and usage.”

The Future of Finance Teams

Zoho Corporation predicts that AI and automation will free finance teams from repetitive tasks, allowing them to focus on strategic initiatives.

CFOs and HR: An Emerging Power Partnership

Why Workforce Planning Matters

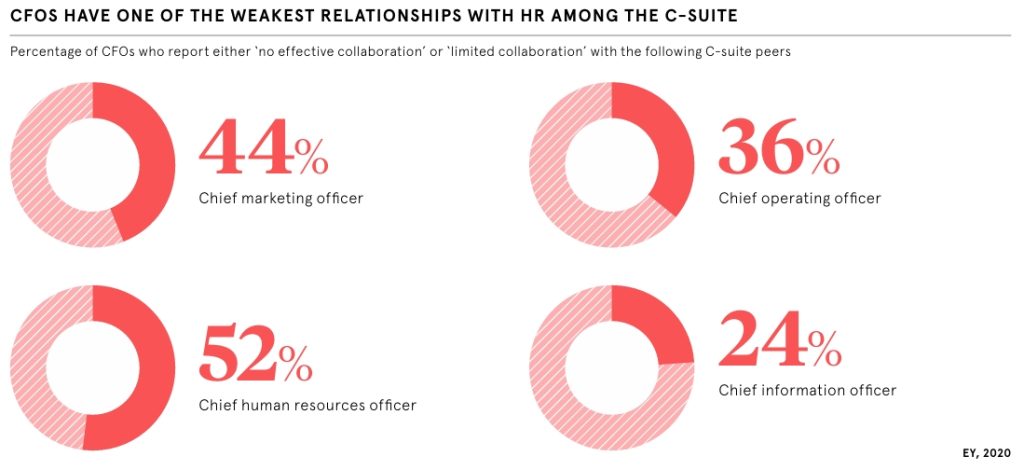

People account for 70% of business costs, yet CFOs often have weak ties with HR:

- 52% of CFOs report limited collaboration with CHROs (EV, 2020).

Alan Pepper (CFO, Essensys) says:

“The CHRO manages culture and talent; the CFO ensures profitability. Together, they optimize workforce ROI.”

Data-Driven Workforce Strategies

Examples of collaboration:

- Sales efficiency analysis – Deciding where to allocate resources.

- Hybrid work models – Assessing office space utilization.

Rob Gorle (Perkbox) adds:

“Data helps set investment hurdles—like expanding a product team only after hitting customer engagement targets.”

Predictive Analytics: The CFO’s New Superpower

Why CFOs Must Lead the Charge

Florian Mueller (Bain & Company) states:

“CFOs interact with data from all business areas. They’re natural owners of predictive analytics.”

Key Applications:

🔹 Revenue Opportunities – E.g., AI-driven agriculture adjustments.

🔹 Operational Efficiency – Predictive maintenance in utilities.

Anand Soni (CFO) highlights:

“CFOs need deeper data dives for forward-looking analysis, especially in risk management.”

Overcoming Challenges

- Upskilling teams in data science.

- Breaking down silos to ensure clean, accessible data.

Conclusion: The CFO as a Transformation Leader

The modern CFO is no longer just a steward of finances—they’re a strategic visionary driving:

- Data-driven cultures

- Real-time decision-making

- Cross-functional collaboration

Final Thought:

“The future CFO embraces technology, eliminates inefficiencies, and upskills talent—while guiding the board into the digital age.”

If you want to read the full report, please check out Raconteur or Board website or NeoForm LinkedIn page.

Need More Insights and Supports for Transformation?

Is your finance team ready for the future? At NeoForm Business Partners, we help CFOs harness data, AI, and predictive analytics to transform decision-making. Explore Neo solutions and contact us today!

1 Comment

CFO and Driving Digital Transformation in Finance - NeoForm Business Partners

[…] Cross-Functional Collaboration: CFOs work closely with IT, HR, and operations to align financial goals with business objectives. […]

Comments are closed.